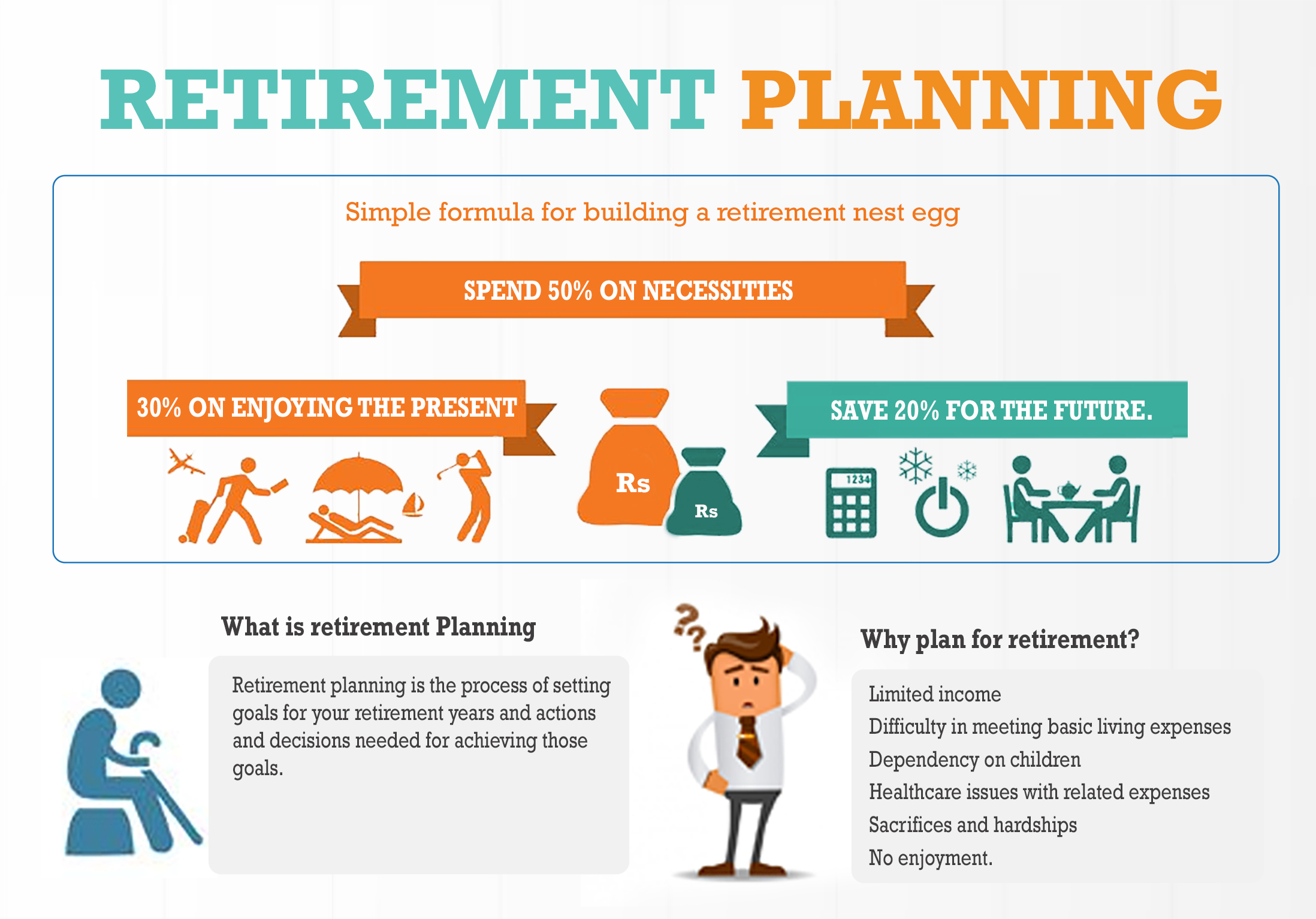

Simple formula for building a retirement nest egg

“Spend 50% on necessities, 30% on enjoying the present, and save 20% for the future.”

What is retirement planning?

Retirement planning is the process of setting goals for your retirement years and actions and decisions needed for achieving those goals. It includes identifying sources of income, estimating expenses and cash flows, implementing a savings program and managing assets.

Why plan for retirement?

Unfortunately, for most individuals living in Pakistan, who have not planned for their retirement, it is a stage of life dominated by:

-

Limited income ;

-

Difficulty in meeting basic living expenses:

-

Dependency on children;

-

Healthcare issues with related expenses;

-

Sacrifices and hardships; and

-

No enjoyment.

For retiring individuals without adequate income during retirement, living on handouts from family members can be both challenging and humiliating. In Pakistan, most workers are not part of a retirement system. Private Citizens mainly depend on:

-

The next generation to support them in their old age;

-

Income from property; and

-

Interest on bank deposits

In Pakistan, there is some coverage through retirement benefit schemes that focus on lump sums such as provident and gratuity schemes. The utility of lump sum benefit systems is limited, as they pass on the responsibility for managing retirement funds and risks of longevity to the retirees. Pension schemes exist but are primarily in the public sector including government and multinationals.

Voluntary Pension System

To enable employed as well as self-employed individuals to provide for their retirement in a regulated environment, the Securities and Exchange Commission of Pakistan (SECP) introduced the Voluntary Pension System (VPS) in 2005. The Voluntary Pension System is regulated by SECP.

The following should be noted with respect to VPS schemes:

-

A Pakistani national over the age of 18 years (salaried or self-employed) with a valid Computerized National Identity Card (CNIC) or National Identity Card for Overseas Pakistanis (NICOP) is eligible to participate in VPS.

-

Under VPS, the employee or the employer (or both) contribute to the employee's individual pension account (IPA) which is invested for the long term. Contributions can be in lump sum or at regular frequency. There is no penalty for missing any payment.

-

The pension fund manager opens an individual pension account (IPA) in the name of the individual, who is referred to as a “Participant”. Each individual pension account (IPA) is assigned a unique identification number (UIN). The funds accumulated are used for payment of a regular pension or lump sum on retirement.

-

To protect pension fund account holders, a VPS separates fund management and custody of funds through the establishment of a trust.

-

To protect pension fund account holders through diversification the SECP has specified an investment and allocation policy for pension funds setting out the broad parameters for investment of contributions received.

-

Individuals can allocate their contributions between equities, debt, money market instruments and commodities in accordance with their investment horizon and risk appetite as reflected in their chosen allocation scheme.

How to start saving for your retirement?

Here are some important points to note and consider:

-

Analyze your income and expenses and ensure that you can spend less than you earn.

-

Prepare a budget that includes regular savings, and stick to it.

-

To ensure that you do not withdraw money from retirement savings account for emergencies, separately save money for emergencies such as unemployment, accidents and medical expenses.

-

Open an individual pension account (IPA) by visiting your local asset management company / pension fund manager today. This is the easiest way to start saving for your retirement. Contact information can be found at the following link: http://mufap.com.pk/members.php

-

If your employer offers a voluntary pension scheme, make sure that you participate in the scheme. Further, if your employer offers a matching program do not miss this opportunity for increasing your retirement savings.

-

Please note that contributions to a voluntary pension scheme during a year (July 1 to June 30) are eligible for a tax credit under Section 63 of the Income Tax Ordinance 2001. The tax liability can be reduced for both self-employed and salaried individuals. You can avail tax credit at your average rate of tax on the amount of actual contribution or 20% of your annual taxable income whichever is lower.

-

Consult with an investment advisor to help you select your investment products. Your present age and expected age of retirement are important for developing an effective retirement strategy. The longer the time horizon to retirement the higher the level of risk you will be able to tolerate in your portfolio. For example, if you have over 20 years until retirement, you could allocate a majority of your assets to stocks. By investing in stocks, you become partial owners of the company and are able to participate in earnings as well as losses. Your longer time horizon will allow you to ride volatility in the market and balance your portfolio.

-

If you are close to retirement, it is advisable to allocate a majority of your investment assets to fixed income securities/bonds. By investing in fixed income securities/bonds, you are essentially lending to companies or governments in exchange for a guaranteed fixed return and a promise to repay the original loan amount at some point in the future. In deciding your allocations to various investment products always used the services of an investment advisor.

Building your retirement nest egg

Here are some important tips:

-

You must have realistic expectations about post-retirement expenses. While your income will decrease your expenses are likely to increase over the long term. Most people argue that after retirement their annual spending will amount to only 70% to 80% of what they spent previously. Such an assumption is often proved unrealistic, especially if unforeseen medical expenses have to be paid.

-

Always seek financial advice from a trusted financial adviser. Financial professionals can help you design a savings plan appropriate for your particular situation.

-

Make a habit of saving regularly and try to increase the amount you set aside each year.

-

Always think long term. Do not focus on the short-term performance of your investments. Instead, stick to your long-term plan and review your portfolio periodically to stay on track.

-

Use a broadly diversified portfolio of stocks and fixed income securities /bonds. The mix of the amount of stocks versus fixed income securities /bonds depends, in part on your age, time to retirement and your ability to tolerate market turbulence or risk.

-

Avoid borrowing from your retirement savings for handling short-term financial problems.

Conclusion

Retirement planning is an ongoing, lifelong process that takes years of commitment to build retirement funds needed for a comfortable retirement. While it is not possible to cover all topics in our brief discussion above, it is hoped that you now have a basic understanding of retirement planning.

In Pakistan, to enable employed as well as self-employed individuals to provide for their retirement in a regulated environment, the Securities and Exchange Commission of Pakistan (SECP) has introduced the Voluntary Pension System (VPS). It is important that you benefit from VPS to build a secure future for your family.

For more information on the Voluntary Pension System (VPS), please read our guidebook at the following link:

Next Action

As stated above it is always advisable to consult with an investment advisor. We strongly recommend that you contact your local asset management company/pension manager today and start saving for your retirement by opening an individual pension account.

Contact information for all asset management companies managing pension funds under VPS is available at the Mutual Fund Association of Pakistan (MUFAP) website at the following link: